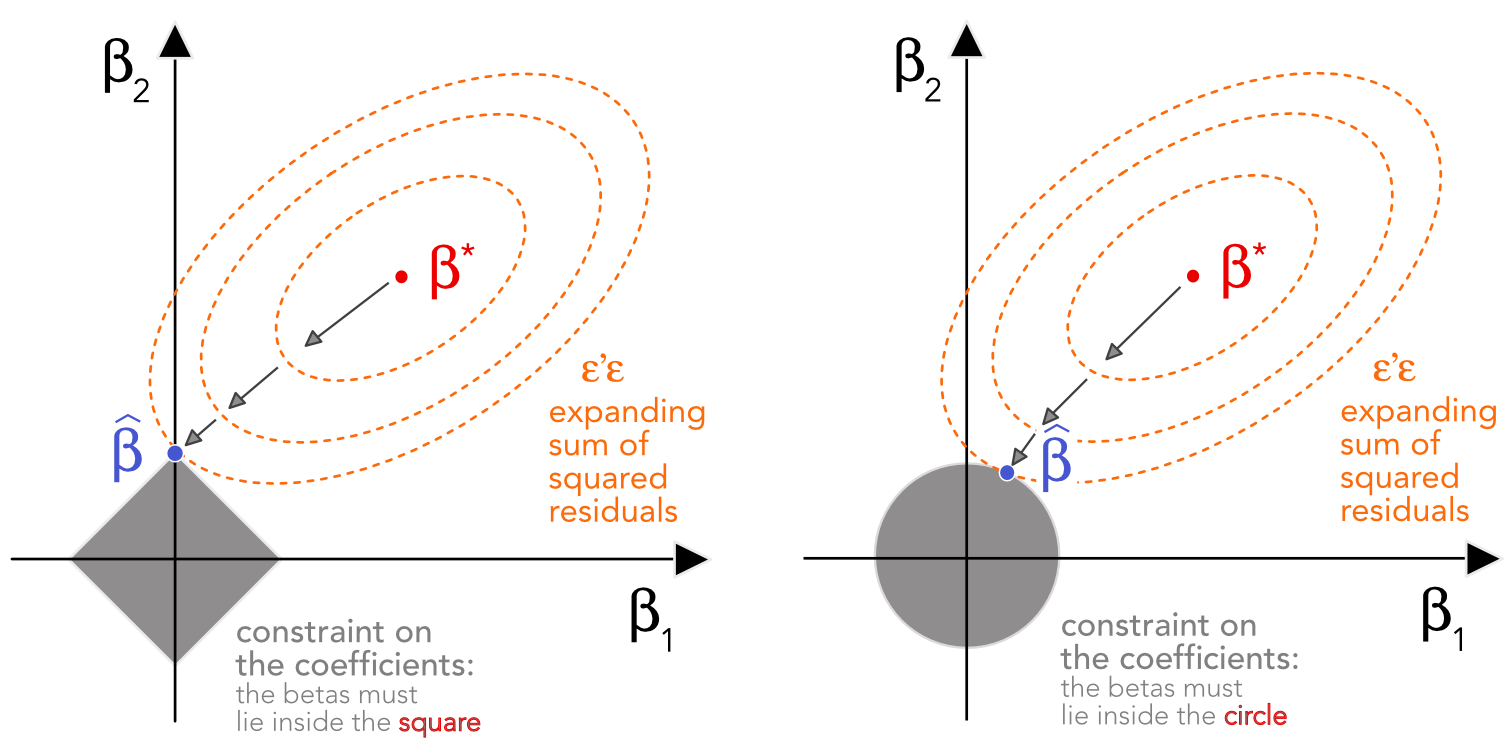

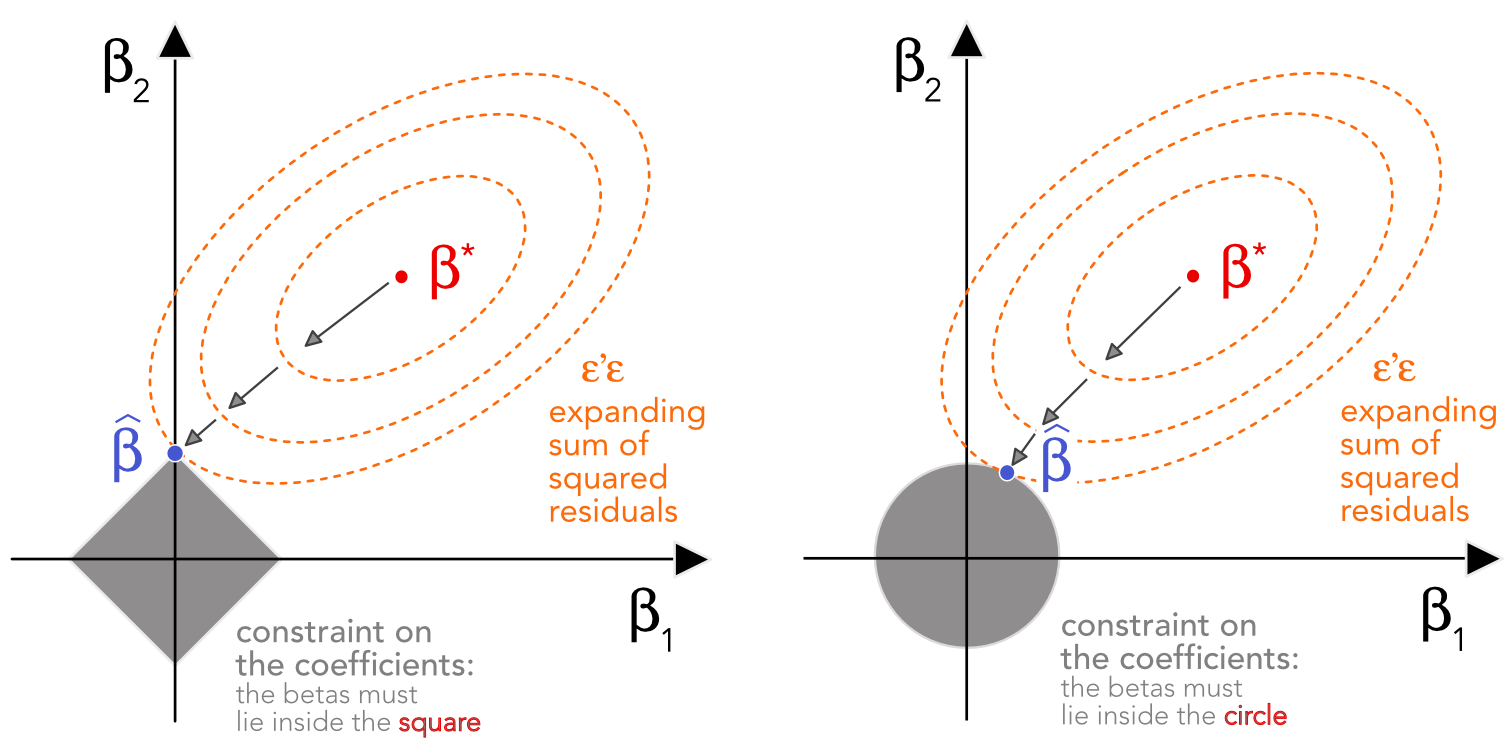

FIGURE 5.1: Schematic view of Lasso (left) versus ridge (right) regressions.

FIGURE 5.1: Schematic view of Lasso (left) versus ridge (right) regressions.

In this chapter, we introduce the widespread concept of regularization for linear models. There are in fact several possible applications for these models. The first one is straightforward: resort to penalizations to improve the robustness of factor-based predictive regressions. The outcome can then be used to fuel an allocation scheme. For instance, Han et al. (2019) and Rapach and Zhou (2019) use penalized regressions to improve stock return prediction when combining forecasts that emanate from individual characteristics.

Similar ideas can be developed for macroeconomic predictions for instance, as in Uematsu and Tanaka (2019). The second application stems from a less known result which originates from Stevens (1998). It links the weights of optimal mean-variance portfolios to particular cross-sectional regressions. The idea is then different and the purpose is to improve the quality of mean-variance driven portfolio weights. We present the two approaches below after an introduction on regularization techniques for linear models.

Other examples of financial applications of penalization can be found in d’Aspremont (2011), Ban, El Karoui, and Lim (2016) and Kremer et al. (2019). In any case, the idea is the same as in the seminal paper Tibshirani (1996): standard (unconstrained) optimization programs may lead to noisy estimates, thus adding a structuring constraint helps remove some noise (at the cost of a possible bias). For instance, Kremer et al. (2019) use this concept to build more robust mean-variance (Markowitz (1952)) portfolios and Freyberger, Neuhierl, and Weber (2020) use it to single out the characteristics that really help explain the cross-section of equity returns.

The ideas behind linear models are at least two centuries old (Legendre (1805) is an early reference on least squares optimization). Given a matrix of predictors $\textbf{X}$, we seek to decompose the output vector $\textbf{y}$ as a linear function of the columns of $\textbf{X}$ (written $\textbf{X}\boldsymbol{\beta}$ ) plus an error term $\boldsymbol{\epsilon}$: $\textbf{y}=\textbf{X}\boldsymbol{\beta}+\boldsymbol{\epsilon}$.

The best choice of $\boldsymbol{\beta}$ is naturally the one that minimizes the error. For analytical tractability, it is the sum of squared errors that is minimized: $L=\boldsymbol{\epsilon}'\boldsymbol{\epsilon}=\sum_{i=1}^I\epsilon_i^2$. The loss $L$ is called the sum of squared residuals (SSR). In order to find the optimal $\boldsymbol{\beta}$, it is imperative to differentiate this loss $L$ with respect to $\boldsymbol{\beta}$ because the first order condition requires that the gradient be equal to zero:

so that the first order condition $\nabla_{\boldsymbol{\beta}}=\textbf{0}$ is satisfied if

which is known as the standard ordinary least squares (OLS) solution of the linear model. If the matrix $\textbf{X}$ has dimensions $I \times K$, then the $\textbf{X}'\textbf{X}$ can only be inverted if the number of rows $I$ is strictly superior to the number of columns $K$. In some cases, that may not hold; there are more predictors than instances and there is no unique value of $\textbf{β}$ that minimizes the loss. If $\textbf{X}'\textbf{X}$ is nonsingular (or positive definite), then the second order condition ensures that $\textbf{β*}$ yields a global minimum for the loss $L$ (the second order derivative of $L$ with respect to $\textbf{β}$, the Hessian matrix, is exactly $\textbf{X}'\textbf{X}$).

Up to now, we have made no distributional assumption on any of the above quantities. Standard assumptions are the following:

Under these hypotheses, it is possible to perform statistical tests related to the $\hat{\boldsymbol{\beta}}$ coefficients. We refer to chapters 2 to 4 in Greene (2018) for a thorough treatment on linear models as well as to chapter 5 of the same book for details on the corresponding tests.

Penalized regressions have been popularized since the seminal work of Tibshirani (1996). The idea is to impose a constraint on the coefficients of the regression, namely that their total magnitude be restrained. In his original paper, Tibshirani (1996) proposes to estimate the following model (LASSO):

for some strictly positive constant $\delta$. Under least square minimization, this amounts to solve the Lagrangian formulation:

for some value $\lambda>0$ which naturally depends on $\delta$ (the lower the $\delta$, the higher the $\lambda$: the constraint is more binding). This specification seems close to the ridge regression ($L^2$ regularization), which is in fact anterior to the Lasso:

and which is equivalent to estimating the following model

but the outcome is in fact quite different, which justifies a separate treatment. Mechanically, as $\lambda$, the penalization intensity, increases (or as $\delta$ in (5.5) decreases), the coefficients of the ridge regression all slowly decrease in magnitude towards zero. In the case of the LASSO, the convergence is somewhat more brutal as some coefficients shrink to zero very quickly. For $\lambda$ sufficiently large, only one coefficient will remain nonzero, while in the ridge regression, the zero value is only reached asymptotically for all coefficients. We invite the interested read to have a look at the survey in Hastie (2020) about all applications of ridge regressions in data science with links to other topics like cross-validation and dropout regularization, among others.

To depict the difference between the Lasso and the ridge regression, let us consider the case of $K=2$ predictors which is shown in Figure 5.1. The optimal unconstrained solution $\boldsymbol{\beta}^*$ is pictured in red in the middle of the space. The problem is naturally that it does not satisfy the imposed conditions. These constraints are shown in light grey: they take the shape of a square $|\beta_1|+|\beta_2| \le \delta$ in the case of the Lasso and a circle $\beta_1^2+\beta_2^2 \le \delta$ for the ridge regression. In order to satisfy these constraints, the optimization needs to look in the vicinity of $\boldsymbol{\beta}^*$ by allowing for larger error levels. These error levels are shown as orange ellipsoids in the figure. When the requirement on the error is loose enough, one ellipsoid touches the acceptable boundary (in grey) and this is where the constrained solution is located.

FIGURE 5.1: Schematic view of Lasso (left) versus ridge (right) regressions.

FIGURE 5.1: Schematic view of Lasso (left) versus ridge (right) regressions.

Both methods work when the number of exogenous variables surpasses that of observations, i.e., in the case where classical regressions are ill-defined. This is easy to see in the case of the ridge regression for which the OLS solution is simply

$\hat{\boldsymbol{\beta}}=(\mathbf{X}'\mathbf{X}+\lambda \mathbf{I}_N)^{-1}\mathbf{X}'\mathbf{Y}.$

The additional term $\lambda \mathbf{I}_N$ compared to Equation (5.1) ensures that the inverse matrix is well-defined whenever $\lambda>0$. As $\lambda$ increases, the magnitudes of the $\hat{\beta}_i$ decrease, which explains why penalizations are sometimes referred to as shrinkage methods (the estimated coefficients see their values shrink).

Zou and Hastie (2005) propose to benefit from the best of both worlds when combining both penalizations in a convex manner (which they call the elasticnet):

which is associated to the optimization program

The main advantage of the LASSO compared to the ridge regression is its selection capability. Indeed, given a very large number of variables (or predictors), the LASSO will progressively rule out those that are the least relevant. The elasticnet preserves this selection ability and Zou and Hastie (2005) argue that in some cases, it is even more effective than the LASSO. The parameter $\alpha \in [0,1]$ tunes the smoothness of convergence (of the coefficients) towards zero. The closer $\alpha$ is to zero, the smoother the convergence.

We begin with simple illustrations of penalized regressions. We start with the LASSO. The illustrations are run on the whole dataset. First, we estimate the coefficients. By default, the function chooses a large array of penalization values so that the results for different penalization intensities ($\lambda$) can be shown immediately.

from sklearn.linear_model import Lasso, Ridge, ElasticNet

y_penalized = data_ml['R1M_Usd'].values # Dependent variable

X_penalized = data_ml[features].values # Predictors

alphas = np.arange(1e-4,1.0e-3,1e-5) # here alpha is used for lambda in scikit-learn

lasso_res = {} # declaring the dict that will receive the model's result

Once the coefficients are computed, they require some wrangling before plotting. Also, there are too many of them, so we only plot a subset of them.

for alpha in alphas: # looping through the different alphas/lambdas values

lasso = Lasso(alpha=alpha) # model

lasso.fit(X_penalized,y_penalized)

lasso_res[alpha] = lasso.coef_ # extract LASSO coefs

df_lasso_res = pd.DataFrame.from_dict(lasso_res).T # transpose the dataframe for plotting

df_lasso_res.columns = features # adding the names of the factors

predictors = (df_lasso_res.abs().sum() > 0.05) # selecting the most relevant

df_lasso_res.loc[:,predictors].plot(xlabel='Lambda',ylabel='Beta',figsize=(12,8)); # Plot!

FIGURE 5.2: LASSO model. The dependent variable is the 1 month ahead return.

The graph plots the evolution of coefficients as the penalization intensity,$\lambda$, increases. For some characteristics, like Ebit_Ta (in orange), the convergence to zero is rapid. Other variables resist the penalization longer, like Mkt_Cap_3M_Usd, which is the last one to vanish. Essentially, this means that at the first order, this variable is an important driver of future 1-month returns in our sample. Moreover, the negative sign of its coefficient is a confirmation (again, in this sample) of the size anomaly, according to which small firms experience higher future returns compared to their larger counterparts.

Next, we turn to ridge regressions.

n_alphas = 50 # declare the number of alphas for ridge

alphas = np.logspace(-2, 4, n_alphas) # transforming into log for Aspect ratio

ridge_res = {} # declaring the dict that will receive the model's result

for alpha in alphas: # looping through the different alphas/lambdas values

ridge = Ridge(alpha=alpha) # model

ridge.fit(X_penalized,y_penalized) # fit the model

ridge_res[alpha] = ridge.coef_ # extract RIDGE coefs

df_ridge_res = pd.DataFrame.from_dict(ridge_res).T # transpose the dataframe for plotting

df_ridge_res.columns = features # adding the names of the factors

df_ridge_res.loc[:,predictors].plot(xlabel='Lambda',ylabel='Beta',figsize=(13,8)); # Plot!

FIGURE 5.3: Ridge regression. The dependent variable is the 1 month ahead return.

In Figure 5.3, the convergence to zero is much smoother. We underline that the x-axis (penalization intensities) have a log-scale. This allows to see the early patterns (close to zero, to the left) more clearly. As in the previous figure, the Mkt_Cap_3M_Usd predictor clearly dominates, with again large negative coefficients. Nonetheless, as $\lambda$ increases, its domination over the other predictor fades. By definition, the elasticnet will produce curves that behave like a blend of the two above approaches. Nonetheless, as long as $\alpha >0$, the selective property of the LASSO will be preserved: some features will see their coefficients shrink rapidly to zero. In fact, the strength of the LASSO is such that a balanced mix of the two penalizations is not reached at $\alpha =1/2$, but rather at a much smaller value (possibly below 0.1).

The idea of constructing sparse portfolios is not new per se (see, e.g., Brodie et al. (2009), Fastrich, Paterlini, and Winker (2015)) and the link with the selective property of the LASSO is rather straightforward in classical quadratic programs. Note that the choice of the $L^1$ norm is imperative because when enforcing a simple $L^2$ norm, the diversification of the portfolio increases (see Coqueret (2015)).

The idea behind this section stems from Goto and Xu (2015) but the cornerstone result was first published by Stevens (1998) and we present it below. We provide details because the derivations are not commonplace in the literature.

In usual mean-variance allocations, one core ingredient is the inverse covariance matrix of assets $\mathbf{\Sigma}^{-1}$. For instance, the maximum Sharpe ratio (MSR) portfolio is given by

where $\mu$ is the vector of expected (excess) returns. Taking $\mathbf{\mu}=\mathbf{1}$ yields the minimum variance portfolio, which is agnostic in terms of the first moment of expected returns (and, as such, usually more robust than most alternatives which try to estimate

$\mu$ and often fail).

Usually, the traditional way is to estimate Σ and to invert it to get the MSR weights. However, several approaches aim at estimating $\boldsymbol{\Sigma}^{-1}$ and we present one of them below. We proceed one asset at a time, that is, one line of $\boldsymbol{\Sigma}^{-1}$ at a time. If we decompose the matrix $\mathbf{\Sigma}$ into:

$\mathbf{\Sigma}= \left[\begin{array}{cc} \sigma^2 & \mathbf{c}' \\ \mathbf{c}& \mathbf{C}\end{array} \right],$

classical partitioning results (e.g., Schur complements) imply

$\small \mathbf{\Sigma}^{-1}= \left[\begin{array}{cc} (\sigma^2 -\mathbf{c}'\mathbf{C}^{-1}\mathbf{c})^{-1} & - (\sigma^2 -\mathbf{c}'\mathbf{C}^{-1}\mathbf{c})^{-1}\mathbf{c}'\mathbf{C}^{-1} \

We are interested in the first line, which has 2 components: the factor $(\sigma^2 -\mathbf{c}'\mathbf{C}^{-1}\mathbf{c})^{-1}$ and the line vector $\mathbf{c}'\mathbf{C}^{-1}$. $\mathbf{C}$ is the covariance matrix of assets $2$ to $N$ and $c$ is the covariance between the first asset and all other assets. The first line of $\mathbf{\Sigma}^{-1}$ is

We now consider an alternative setting. We regress the returns of the first asset on those of all other assets:

where $\mathbf{R}_{-1}$ gathers the returns of all assets except the first one. The OLS estimator for $\mathbf{\beta}_1$ is

and this is the partitioned form (when a constant is included to the regression) stemming from the Frisch-Waugh-Lovell theorem (see chapter 3 in Greene (2018)).

In addition,

The proof of this last fact is given below.

With $\mathbf{X}$ being the concatenation of $\mathbf{1}_T$ with returns $\mathbf{R}_{-1}$ and with $\mathbf{y}=\mathbf{r}_1$, the classical expression of the $R^2$ is

$R^2=1-\frac{\mathbf{\epsilon}'\mathbf{\epsilon}}{T\sigma_Y^2}=1-\frac{\mathbf{y}'\mathbf{y}-\hat{\mathbf{\beta}'}\mathbf{X}'\mathbf{X}\hat{\mathbf{\beta}}}{T\sigma_Y^2}=1-\frac{\mathbf{y}'\mathbf{y}-\mathbf{y}'\mathbf{X}\hat{\mathbf{\beta}}}{T\sigma_Y^2},$

with fitted values $\mathbf{X}\hat{\mathbf{\beta}}=\hat{a_1}\mathbf{1}_T+\mathbf{R}_{-1}\mathbf{C}^{-1}\mathbf{c}$ Hence,

where in the fourth equality we have plugged $\hat{a}_1=\frac{\mathbf{1'}_T}{T}(\mathbf{r}_1-\mathbf{R}_{-1}\mathbf{C}^{-1}\mathbf{c})$. Note that there is probably a simpler proof, see, e.g., section 3.5 in Greene (2018).

Combining ((5.9), ((5.11)) and ((5.12)), we get that the first line of $\mathbf{\Sigma}^{-1}$ is equal to

Given the first line of $\mathbf{\Sigma}^{-1}$, it suffices to multiply by $\mu$ to get the portfolio weight in the first asset (up to a scaling constant).

There is a nice economic intuition behind the above results which justifies the term “sparse hedging”. We take the case of the minimum variance portfolio, for which $\boldsymbol{\mu}=\boldsymbol{1}$. In Equation (5.10), we try to explain the return of asset 1 with that of all other assets. In the above equation, up to a scaling constant, the portfolio has a unit position in the first asset and $-\hat{\boldsymbol{\beta}}_1$ positions in all other assets. Hence, the purpose of all other assets is clearly to hedge the return of the first one. In fact, these positions are aimed at minimizing the squared errors of the aggregate portfolio for the first asset (these errors are exactly $\mathbf{\epsilon}_1$). Moreover, the scaling factor $\sigma^{-2}_{\epsilon_1}$ is also simple to interpret: the more we trust the regression output (because of a small $\sigma^{2}_{\epsilon_1}$), the more we invest in the hedging portfolio of the asset.

This reasoning is easily generalized for any line of $\mathbf{\Sigma}^{-1}$, which can be obtained by regressing the returns of asset $i$ on the returns of all other assets. If the allocation scheme has the form ((5.8)) for given values of $\mu$, then the pseudo-code for the sparse portfolio strategy is the following.

At each date (which we omit for notational convenience),

For all stocks $i$,

where we recall that the vectors $\mathbf{\beta}_{i|}=[\mathbf{\beta}_{i|1},\dots,\mathbf{\beta}_{i|i-1},\mathbf{\beta}_{i|i+1},\dots,\mathbf{\beta}_{i|N}]$ are the coefficients from regressing the returns of asset $i$ against the returns of all other assets.

The introduction of the penalization norms is the new ingredient, compared to the original approach of Stevens (1998). The benefits are twofold: first, introducing constraints yields weights that are more robust and less subject to errors in the estimates of $μ$; second, because of sparsity, weights are more stable, less leveraged and thus the strategy is less impacted by transaction costs. Before we turn to numerical applications, we mention a more direct route to the estimation of a robust inverse covariance matrix: the Graphical LASSO. The GLASSO estimates the precision matrix (inverse covariance matrix) via maximum likelihood while imposing constraints/penalizations on the weights of the matrix. When the penalization is strong enough, this yields a sparse matrix, i.e., a matrix in which some and possibly many coefficients are zero. We refer to the original article Friedman, Hastie, and Tibshirani (2008) for more details on this subject.

The interest of sparse hedging portfolios is to propose a robust approach to the estimation of minimum variance policies. Indeed, since the vector of expected returns $μ$ is usually very noisy, a simple solution is to adopt an agnostic view by setting $\boldsymbol{\mu}=\boldsymbol{1}$. In order to test the added value of the sparsity constraint, we must resort to a full backtest. In doing so, we anticipate the content of Chapter 12.

We first prepare the variables. Sparse portfolios are based on returns only; we thus base our analysis on the dedicated variable in matrix/rectangular format (returns) which were created at the end of Chapter 1.

Then, we initialize the output variables: portfolio weights and portfolio returns. We want to compare three strategies: an equally weighted (EW) benchmark of all stocks, the classical global minimum variance portfolio (GMV) and the sparse-hedging approach to minimum variance.

t_oos = returns.index[returns.index > separation_date].values # Out-of-sample data

Tt = len(t_oos) # Nb of dates

nb_port = 3 # Nb of portfolios/strats

port_weights = {} # Initial portf. weights in dict

port_returns = {} # Initial portf. returns in dict

Next, because it is the purpose of this section, we isolate the computation of the weights of sparse-hedging portfolios. In the case of minimum variance portfolios, when $\boldsymbol{\mu}=\boldsymbol{1}$, the weight in asset 1 will simply be the sum of all terms in Equation (5.13) and the other weights have similar forms.

def weights_sparsehedge(returns, alpha, Lambda):

weights = [] # Initiate weights in list

lr = ElasticNet(alpha=alpha,l1_ratio=Lambda) # ?? elasticnet

for col in returns.columns: # Loop on the assets

y = returns[col].values # Dependent variable

X = returns.drop(col, axis=1).values # Independent variable

lr.fit(X,y)

err = y - lr.predict(X) # Prediction errors

w = (1-np.sum(lr.coef_))/np.var(err) # Output: weight of asset i

weights.append(w)

return weights / np.sum(weights) # Normalisation of weights

In order to benchmark our strategy, we define a meta-weighting function that embeds three strategies: (1) the EW benchmark, (2) the classical GMV and (3) the sparse-hedging minimum variance. For the GMV, since there are much more assets than dates, the covariance matrix is singular. Thus, we have a small heuristic shrinkage term. For a more rigorous treatment of this technique, we refer to the original article Ledoit and Wolf (2004) and to the recent improvements mentioned in Ledoit and Wolf (2017). In short, we use $\hat{\boldsymbol{\Sigma}}=\boldsymbol{\Sigma}_S+\delta \boldsymbol{I}$ for some small constant $\delta$ (equal to 0.01 in the code below).

def weights_multi(returns, j, alpha, Lambda):

N = returns.shape[1]

if j == 0: # j = 0 => EW

return np.repeat(1/N,N)

elif j == 1: # j = 1 => Minimum Variance

sigma = np.cov(returns.T) + 1e-2 * np.identity(N) # Covariance matrix + regularizing term

w = np.matmul(np.linalg.inv(sigma),np.repeat(1,N)) # Multiply & inverse

return w / np.sum(w) # Normalize

elif j == 2: # j = 2 => Penalised / elasticnet

return weights_sparsehedge(returns, alpha, Lambda)

Finally, we proceed to the backtesting loop. Given the number of assets, the execution of the loop takes a few minutes. At the end of the loop, we compute the standard deviation of portfolio returns (monthly volatility). This is the key indicator as minimum variance seeks to minimize this particular metric.

for m, month in np.ndenumerate(t_oos): # Loop = rebal. dates

temp_data = returns.loc[returns.index < month] # Data for weights

realised_returns = returns.loc[returns.index == month].values # OOS returns

weights_temp = {}

returns_temp = {}

for j in range(nb_port): # Loop over strats

wgts = weights_multi(temp_data, j, 0.1, 0.1) # Hard-coded params!

rets = np.sum(wgts * realised_returns) # Portf. returns

weights_temp[j] = wgts

returns_temp[j] = rets

port_weights[month] = weights_temp # not used but created

port_returns[month] = returns_temp

port_returns_final = pd.concat(

{k: pd.DataFrame.from_dict(v, 'index') for k, v in port_returns.items()},

axis=0).reset_index() # Dict comprehension approach -- https://www.python.org/dev/peps/pep-0274/

colnames = ['date','strategy','return'] # Colnames

port_returns_final.columns = colnames # Colnames

strategies_name = {0:'EW',1:'MV',2:'Sparse'}

port_returns_final['strategy'] = port_returns_final['strategy'].replace(strategies_name)

pd.DataFrame(port_returns_final.groupby('strategy')['return'].std()).T # Portfolio volatilities (monthly scale)

| strategy | EW | MV | Sparse |

|---|---|---|---|

| return | 0.041804 | 0.033504 | 0.034736 |

The aim of the sparse hedging restrictions is to provide a better estimate of the covariance structure of assets so that the estimation of minimum variance portfolio weights is more accurate. From the above exercise, we see that the monthly volatility is indeed reduced when building covariance matrices based on sparse hedging relationships. This is not the case if we use the shrunk sample covariance matrix because there is probably too much noise in the estimates of correlations between assets. Working with daily returns would likely improve the quality of the estimates. But the above backtest shows that the penalized methodology performs well even when the number of observations (dates) is small compared to the number of assets.

The topic of predictive regressions sits on a collection of very interesting articles. One influential contribution is Stambaugh (1999), where the author shows the perils of regressions in which the independent variables are autocorrelated. In this case, the usual OLS estimate is biased and must therefore be corrected. The results have since then been extended in numerous directions (see Campbell and Yogo (2006) and Hjalmarsson (2011), the survey in Gonzalo and Pitarakis (2018) and, more recently, the study of Xu (2020) on predictability over multiple horizons).

A second important topic pertains to the time-dependence of the coefficients in predictive regressions. One contribution in this direction is Dangl and Halling (2012), where coefficients are estimated via a Bayesian procedure. More recently Kelly, Pruitt, and Su (2019) use time-dependent factor loadings to model the cross-section of stock returns. The time-varying nature of coefficients of predictive regressions is further documented by Henkel, Martin, and Nardari (2011) for short term returns. Lastly, Farmer, Schmidt, and Timmermann (2019) introduce the concept of pockets of predictability: assets or markets experience different phases; in some stages, they are predictable and in some others, they aren’t. Pockets are measured both by the number of days that a t-statistic is above a particular threshold and by the magnitude of the $R^2$ over the considered period. Formal statistical tests are developed by Demetrescu et al. (2020).

The introduction of penalization within predictive regressions goes back at least to Rapach, Strauss, and Zhou (2013), where they are used to assess lead-lag relationships between US markets and other international stock exchanges. More recently, Alexander Chinco, Clark-Joseph, and Ye (2019) use LASSO regressions to forecast high frequency returns based on past returns (in the cross-section) at various horizons. They report statistically significant gains. Han et al. (2019) and Rapach and Zhou (2019) use LASSO and elasticnet regressions (respectively) to improve forecast combinations and single out the characteristics that matter when explaining stock returns.

These contributions underline the relevance of the overlap between predictive regressions and penalized regressions. In simple machine-learning based asset pricing, we often seek to build models such as that of Equation (3.6). If we stick to a linear relationship and add penalization terms, then the model becomes:

$r_{t+1,n} = \alpha_n + \sum_{k=1}^K\beta_n^kf^k_{t,n}+\epsilon_{t+1,n}, \quad \text{s.t.} \quad (1-\alpha)\sum_{j=1}^J |\beta_j| +\alpha\sum_{j=1}^J \beta_j^2< \theta$

where we use $f^k_{t,n}$ or $x_{t,n}^k$ interchangeably and $\theta$ is some penalization intensity. Again, one of the aims of the regularization is to generate more robust estimates. If the patterns extracted hold out of sample, then

$\hat{r}_{t+1,n} = \hat{\alpha}_n + \sum_{k=1}^K\hat{\beta}_n^kf^k_{t,n},$

will be a relatively reliable proxy of future performance.

Given the form of our dataset, implementing penalized predictive regressions is easy.

y_penalized_train = training_sample['R1M_Usd'].values # Dependent variable

X_penalized_train = training_sample[features].values # Predictors

model = ElasticNet(alpha=0.1, l1_ratio=0.1) # model

fir_pen_pred=model.fit(X_penalized_train,y_penalized_train) # fitting the model

We then report two key performance measures: the mean squared error and the hit ratio, which is the proportion of times that the prediction guesses the sign of the return correctly. A detailed account of metrics is given later in the book (Chapter 12).

y_penalized_test = testing_sample['R1M_Usd'].values # Dependent variable

X_penalized_test = testing_sample[features].values # Predictors

mse = np.mean((fir_pen_pred.predict(X_penalized_test) - y_penalized_test)**2)

print(f'MSE: {mse}')

MSE: 0.03699695809185004

hitratio = np.mean(fir_pen_pred.predict(X_penalized_test) * y_penalized_test > 0)

print(f'Hit Ratio: {hitratio}')

Hit Ratio: 0.5460346399270738

From an investor’s standpoint, the MSEs (or even the mean absolute error) are hard to interpret because it is complicated to map them mentally into some intuitive financial indicator. In this perspective, the hit ratio is more natural. It tells the proportion of correct signs achieved by the predictions. If the investor is long in positive signals and short in negative ones, the hit ratio indicates the proportion of ‘correct’ bets (the positions that go in the expected direction). A natural threshold is 50% but because of transaction costs, 51% of accurate forecasts probably won’t be profitable. The figure 0.546 can be deemed a relatively good hit ratio, though not a very impressive one.

On the test sample, evaluate the impact of the two elastic net parameters on out-of-sample accuracy.

Ban, Gah-Yi, Noureddine El Karoui, and Andrew EB Lim. 2016. “Machine Learning and Portfolio Optimization.” Management Science 64 (3): 1136–54.

Brodie, Joshua, Ingrid Daubechies, Christine De Mol, Domenico Giannone, and Ignace Loris. 2009. “Sparse and Stable Markowitz Portfolios.” Proceedings of the National Academy of Sciences 106 (30): 12267–72.

Campbell, John Y, and Motohiro Yogo. 2006. “Efficient Tests of Stock Return Predictability.” Journal of Financial Economics 81 (1): 27–60.

Chinco, Alexander, Adam D Clark-Joseph, and Mao Ye. 2019. “Sparse Signals in the Cross-Section of Returns.” Journal of Finance 74 (1): 449–92.

Coqueret, Guillaume. 2015. “Diversified Minimum-Variance Portfolios.” Annals of Finance 11 (2): 221–41.

Dangl, Thomas, and Michael Halling. 2012. “Predictive Regressions with Time-Varying Coefficients.” Journal of Financial Economics 106 (1): 157–81.

d’Aspremont, Alexandre. 2011. “Identifying Small Mean-Reverting Portfolios.” Quantitative Finance 11 (3): 351–64.

Demetrescu, Matei, Iliyan Georgiev, Paulo MM Rodrigues, and AM Taylor. 2020. “Testing for Episodic Predictability in Stock Returns.” Journal of Econometrics Forthcoming.

Farmer, Leland, Lawrence Schmidt, and Allan Timmermann. 2019. “Pockets of Predictability.” SSRN Working Paper 3152386.

Fastrich, Björn, Sandra Paterlini, and Peter Winker. 2015. “Constructing Optimal Sparse Portfolios Using Regularization Methods.” Computational Management Science 12 (3): 417–34.

Freyberger, Joachim, Andreas Neuhierl, and Michael Weber. 2020. “Dissecting Characteristics Nonparametrically.” Review of Financial Studies 33 (5): 2326–77.

Friedman, Jerome, Trevor Hastie, and Robert Tibshirani. 2008. “Sparse Inverse Covariance Estimation with the Graphical Lasso.” Biostatistics 9 (3): 432–41.

Gonzalo, Jesús, and Jean-Yves Pitarakis. 2018. “Predictive Regressions.” In Oxford Research Encyclopedia of Economics and Finance.

Goto, Shingo, and Yan Xu. 2015. “Improving Mean Variance Optimization Through Sparse Hedging Restrictions.” Journal of Financial and Quantitative Analysis 50 (6): 1415–41.

Greene, William H. 2018. Econometric Analysis, Eighth Edition. Pearson Education.

Han, Yufeng, Ai He, D Rapach, and Guofu Zhou. 2019. “Firm Characteristics and Expected Stock Returns.” SSRN Working Paper 3185335.

Hastie, Trevor. 2020. “Ridge Regression: An Essential Concept in Data Science.” arXiv Preprint, no. 2006.00371.

Henkel, Sam James, J Spencer Martin, and Federico Nardari. 2011. “Time-Varying Short-Horizon Predictability.” Journal of Financial Economics 99 (3): 560–80.

Hjalmarsson, Erik. 2011. “New Methods for Inference in Long-Horizon Regressions.” Journal of Financial and Quantitative Analysis 46 (3): 815–39.

Kelly, Bryan T, Seth Pruitt, and Yinan Su. 2019. “Characteristics Are Covariances: A Unified Model of Risk and Return.” Journal of Financial Economics 134 (3): 501–24.

Kremer, Philipp J, Sangkyun Lee, Małgorzata Bogdan, and Sandra Paterlini. 2019. “Sparse Portfolio Selection via the Sorted L1-Norm.” Journal of Banking & Finance, 105687.

Ledoit, Olivier, and Michael Wolf. 2004. “A Well-Conditioned Estimator for Large-Dimensional Covariance Matrices.” Journal of Multivariate Analysis 88 (2): 365–411.

Ledoit, Olivier, and Michael Wolf. 2017. “Nonlinear Shrinkage of the Covariance Matrix for Portfolio Selection: Markowitz Meets Goldilocks.” Review of Financial Studies 30 (12): 4349–88.

Legendre, Adrien Marie. 1805. Nouvelles Méthodes Pour La détermination Des Orbites Des Comètes. F. Didot.

Markowitz, Harry. 1952. “Portfolio Selection.” Journal of Finance 7 (1): 77–91.

Rapach, David E, Jack K Strauss, and Guofu Zhou. 2013. “International Stock Return Predictability: What Is the Role of the United States?” Journal of Finance 68 (4): 1633–62.

Rapach, David, and Guofu Zhou. 2019. “Time-Series and Cross-Sectional Stock Return Forecasting: New Machine Learning Methods.” SSRN Working Paper 3428095.

Stambaugh, Robert F. 1999. “Predictive Regressions.” Journal of Financial Economics 54 (3): 375–421.

Stevens, Guy VG. 1998. “On the Inverse of the Covariance Matrix in Portfolio Analysis.” Journal of Finance 53 (5): 1821–7.

Tibshirani, Robert. 1996. “Regression Shrinkage and Selection via the Lasso.” Journal of the Royal Statistical Society. Series B (Methodological), 267–88.

Uematsu, Yoshimasa, and Shinya Tanaka. 2019. “High-Dimensional Macroeconomic Forecasting and Variable Selection via Penalized Regression.” Econometrics Journal 22 (1): 34–56.

Xu, Ke-Li. 2020. “Testing for Multiple-Horizon Predictability: Direct Regression Based Versus Implication Based.” Review of Financial Studies Forthcoming.

Zou, Hui, and Trevor Hastie. 2005. “Regularization and Variable Selection via the Elastic Net.” Journal of the Royal Statistical Society: Series B (Statistical Methodology) 67 (2): 301–20.